Indonesia-Japan support wider local currency use for trade transaction

09 December 2019

Indonesia-Japan support wider local currency use for trade transaction

The MoU will lead the Indonesian and Japanese authorities to deeper cooperation in information sharing and regular discussions

Jakarta (ANTARA) - Indonesia and Japan support broader use of local currencies for bilateral trade and direct investment transactions following the inking of a memorandum of understanding (MoU) on the local currency settlement (LCS) framework in Tokyo, Thursday.

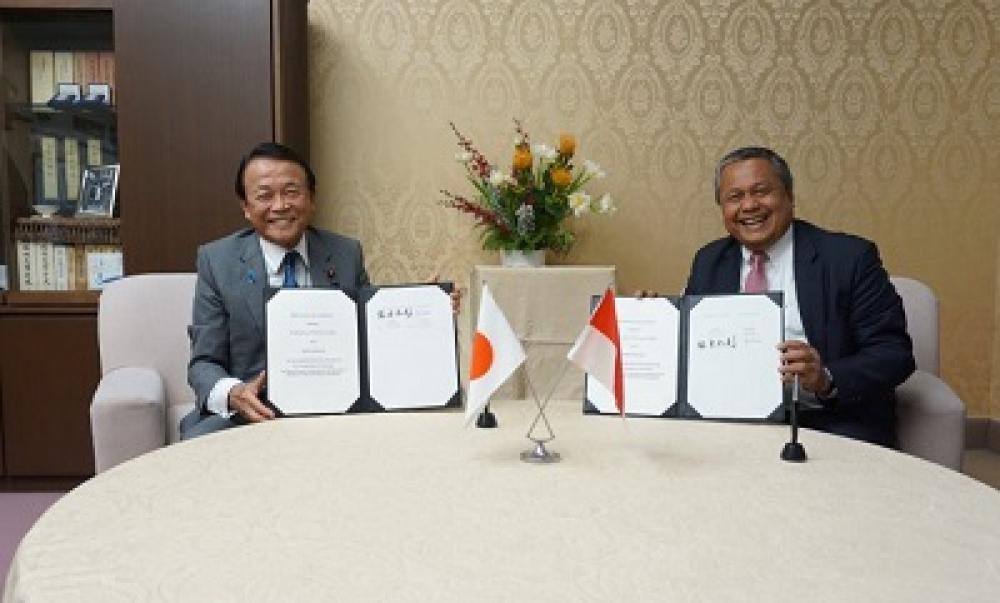

The MoU, signed by Bank Indonesia (BI) Governor Perry Warjiyo and Japanese Finance Minister Taro Aso, has set the scene for the wider use of Rupiah and Yen in both nations’ bilateral trade and direct investment transactions.

The agreement between the Japanese Finance Ministry and the central bank of Indonesia had enabled the two parties to apply a direct quote and interbank trading of the Yen and Rupiah, Bank Indonesia noted in its press statement.

The MoU will lead the Indonesian and Japanese authorities to deeper cooperation in information sharing and regular discussions.

For Bank Indonesia, the LCS framework was a key milestone for both nations to intensify their cooperation in the financial sector and believed to contribute to the wider use of local currencies for bilateral trade and direct investment transactions.

On Dec 23, 2016, BI had also signed a similar MoU with Bank Negara Malaysia (BNM) and Bank of Thailand (BOT).

As published on the central bank's official website, the initiatives taken by these three central banks were part of their persistent endeavor to promote wider use of local currencies to facilitate and drive trade and investment in the three countries.

To operationalize the frameworks, the central banks had appointed banks that fulfilled key qualifications to facilitate bilateral trade, according to BI.

BI and Bank Negara Malaysia had appointed several reputable banks in Indonesia and Malaysia to support the operationalization of the rupiah-ringgit framework, including BRI, Bank Mandiri, BCA, CIMB Bank Berhad, and RHB Bank Berhad.

The operationalization of the rupiah-bath framework is supported by banks, such as BRI, Bank Mandiri, BCA, BNI, Bangkok Bank PCL, Bank of Ayudhya PCL, Kasikornbank PCL, and Krung Thai Bank PCL.